Story by By Steven Sibley, MBA/Healthcare Administration

I enjoyed a 36 year career in the military, in the Air Force and Army, on active duty and in the reserve. I was honorably discharged from the Active Guard Reserve (AGR) in 2017 at the age of 61, after 10 years as an Army Reserve Career Counsellor, where my primary duties were recruiting, retention, and educating reservists about their benefits. Now, I do the same for military retirees with their healthcare benefits. While we have great healthcare benefits, many retirees do not access or understand how to maximize them. In my opinion, they make the following three crucial missteps.

First, many retirees fail to use the VA Healthcare System or file for VA disability. Generally, anyone who has served on active duty, is eligible for both these benefits. Veterans can seek care with the Oklahoma VA Hospital by enrolling into the VA’s OKC downtown location, room 1B109. Veterans Services Officers (VSOs) are in the same room who can assist with filing disability claims. Claims can also be file at most VFW and American Legion post’s, the DAV, and the Oklahoma Department of Veterans Affairs (ODVA).

Secondly, many retirees seek another career after leaving active service. Those employers generally offer healthcare benefits. Since retirees are eligible for Tricare Prime or Select up to age 65, they should carefully review their employer plan with Tricare, to see which offers the best benefits and lowest costs. Once a retiree turns 65, they will convert to Medicare with Tricare for Life (TFL). TFL is a premium free wrap around plan, secondary to Medicare, with prescription drug coverage (aka express scripts). Once on Medicare, there is no need for a retiree to continue paying for an employer health plan, which becomes the 3rd payor. This means they only pay the remaining balance after both Medicare, the primary coverage, and TFL, the secondary pays everything Medicare doesn’t. In this scenario, there would be no unpaid balance, so there would be no claim to file with a 3rd payor. It’s simply insurance you do not need.

The third problem is that there is little clear training given about TFL and exactly how it works. Retirees just know that they go to the doctor, get care, and don’t get a bill. While that’s a great benefit, veterans deserve and can access more from the Medicare portion of their TFL by using Medicare Part C (Medicare Advantage) which will positively impact their health, wellness, and more.

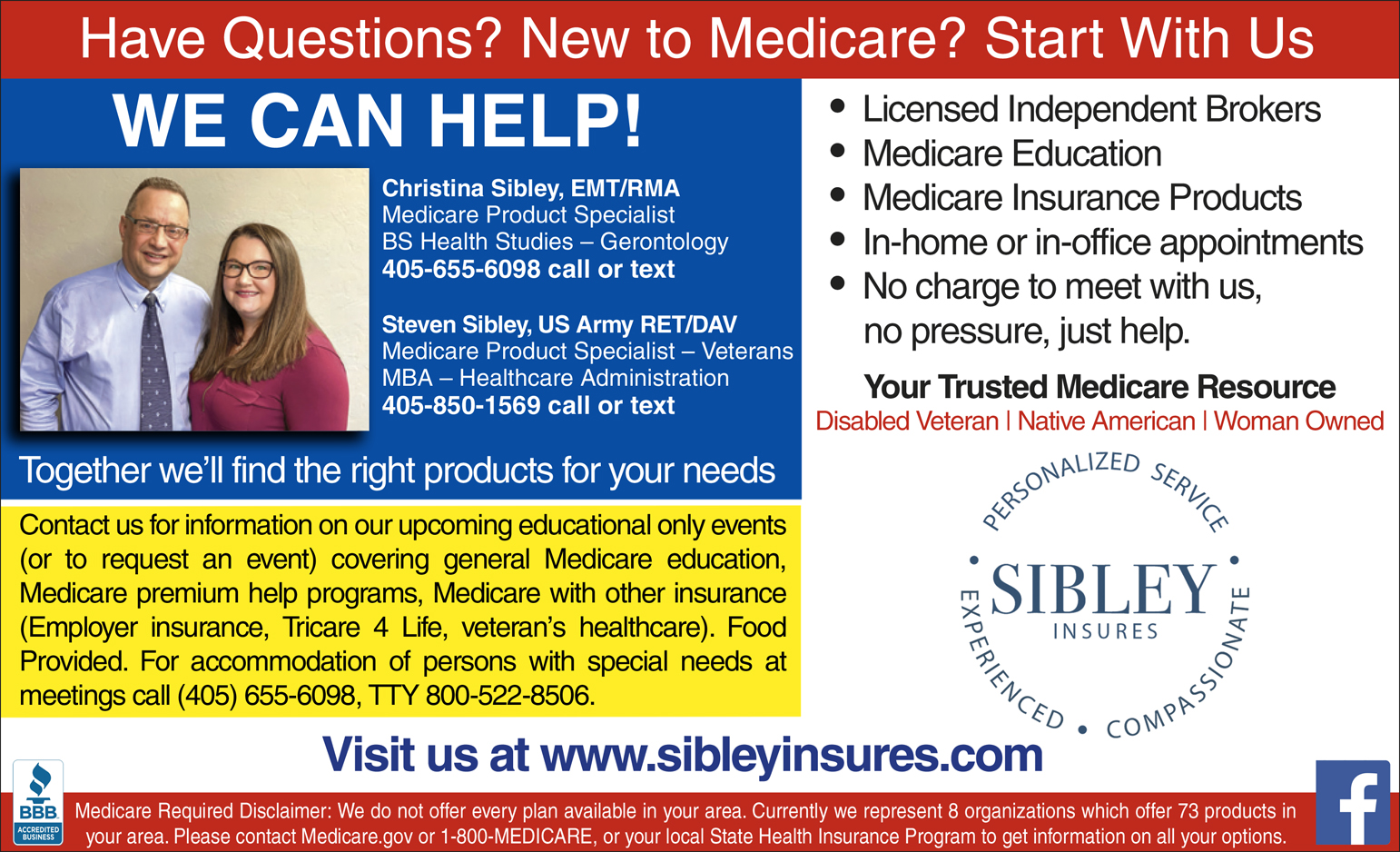

I offer needed education, along with answers and advice to both veterans and their beneficiaries about their healthcare benefits. No cost, no pressure, just help. We’ll sit down and have a conversation until we are satisfied that you understand all that you need to know to make an informed decision about ALL the great healthcare you’ve earned and deserve for you and your dependents. See my ad on this page, and give me a call at 405-850-1569.